A Four-Lane Highway Comparator

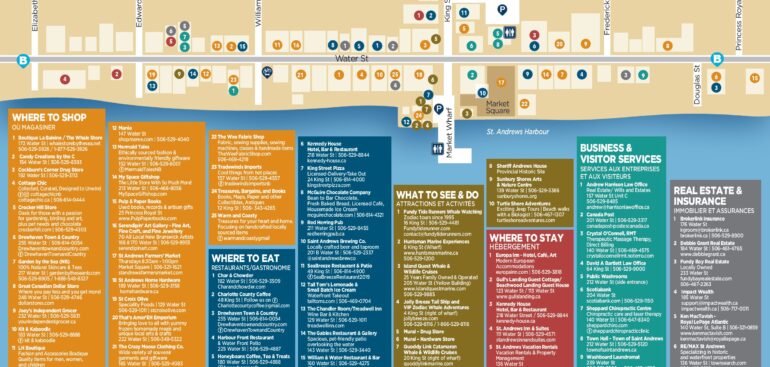

Saint Andrews Route 1 & The GTHA QEW & Highway 401

by John G. Kelly

B.Com., D.PIR., LL.B.,M.S.Sc., M.A. (Jud.Admin.), F.CIS.

john@activeretirement.ca ; www.johngkelly.ca

Yes, I do live life to the fullest in the idyllic historic town of Saint Andrews by the Sea. But on occasion, I do have to go into the city, that being Saint John, to access the kinds of goods and services you invariably find in crowded downtowns and malls. One of those recent trips was a visit to Costco.

That entailed driving on Route 1, the four-lane highway that extends from the border town of St. Stephen to Saint John and beyond. Having lived in the Greater Toronto Hamilton Area (the GTHA) for 35 years I’m well versed in four-lane highway driving. Or at least I thought I was until I moved to Saint Andrews.

I’d been conditioned to know when to and when not to drive on ether the Queen Elizabeth Way (QEW) or Highway 401 that envelops the GTHA. Unless it was an absolute necessity, you avoided going anywhere in the GTHA that required you to use the “expressways” between 6AM-9AM or 3PM-7PM. The four-lane QEW and Highway 401 of double four lane (yes, eight lanes) are expressways in name only. In reality, they were “car – crawlers”. You were ensnared in bumper-to-bumper traffic jams. A 20 – 30km commute might well entail a 1-2 hour nerve-wracking drive with your hands tightly gripping the wheel and you never taking your eyes off the road.

Now when I decide to go into Saint John, a 110-120 km commute, I can plan my departure for any time of the day that best fits with my schedule. Once on the four-lane Route 1 highway I put my car into the cruise control mode and position myself for a relaxing ride. There are never more than 3-4 cars or trucks within my zone. I don’t have a white-knuckle grip on the steering wheel. Although I certainly keep my eyes on the road I can also look around and enjoy the scenery. And I never tire of looking at the Bay of Fundy or the streams and lakes that abut Route 1. Not surprisingly, 45-50 minutes later, I feel relaxed when I arrive at my destinations. There’s no rush. I can take my time to do what needs to be done and am never dreading the return drive home, no matter what the time of day. It’s just another opportunity to get back on Route 1, put my car into cruise control enjoy the scenery and listen to the radio or play a CD all the way home.

Come to Saint Andrews and experience an enjoyable four-lane commute.